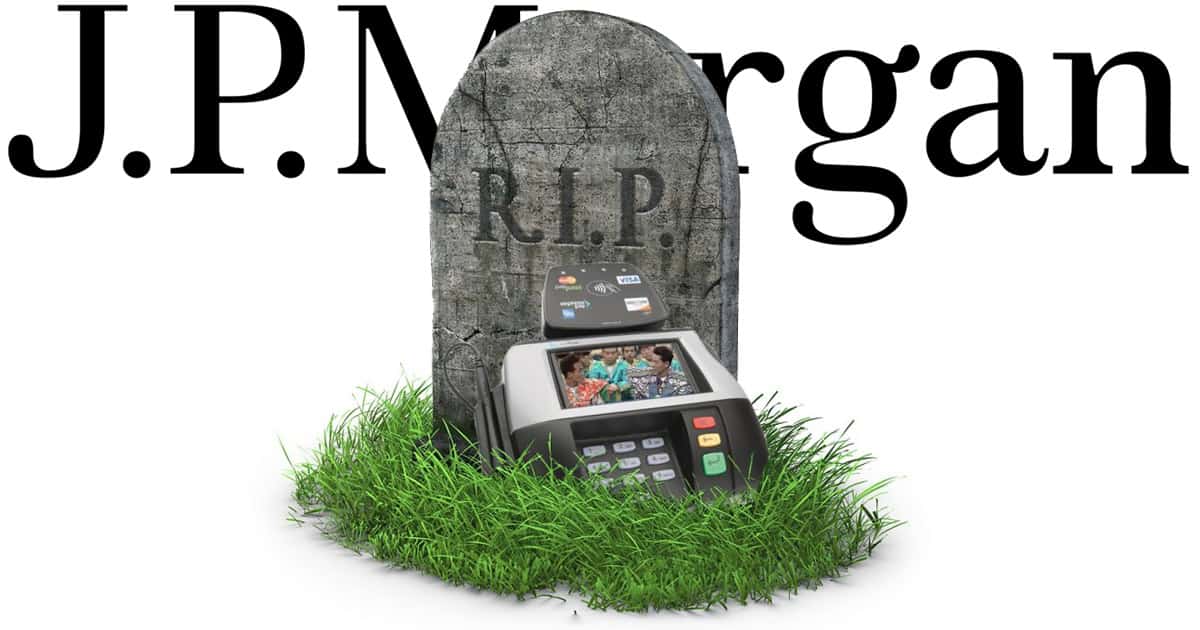

Then there was CurrentC and its parent company MCX. This was the company that was going to larn Apple a lesson with its so-called “Apple Pay.” Wait, you don’t remember that? That could be because CurrentC was a big phat failure predicated on what retailers wanted rather than what consumers want. Enter Wall Street giant JPMorgan. That company bought a stake in MCX in August of 2016—because it was doing so well, I suppose. And on Friday, the bank announced it had purchased what’s left of MCX’s technology, its FinTech payment technology. Again, because it’s so awesome. JP Morgan plans to add FinTech to Chase Pay, its own soon-to-be-erstwhile mobile payment platform. Or maybe I’m just cynical. Either way…😂

Check It Out: JP Morgan Buys CurrentC Technology for the Lawls

Politics? Really?

If they decide to spend the big bucks to get it out there (huge incentives to stores), it’ll be everywhere. Most people won’t think twice about what machine their phone is connected to when paying. They’re not smart enough to understand why ApplePay is better. FIfty percent of the people in this country elected this president.