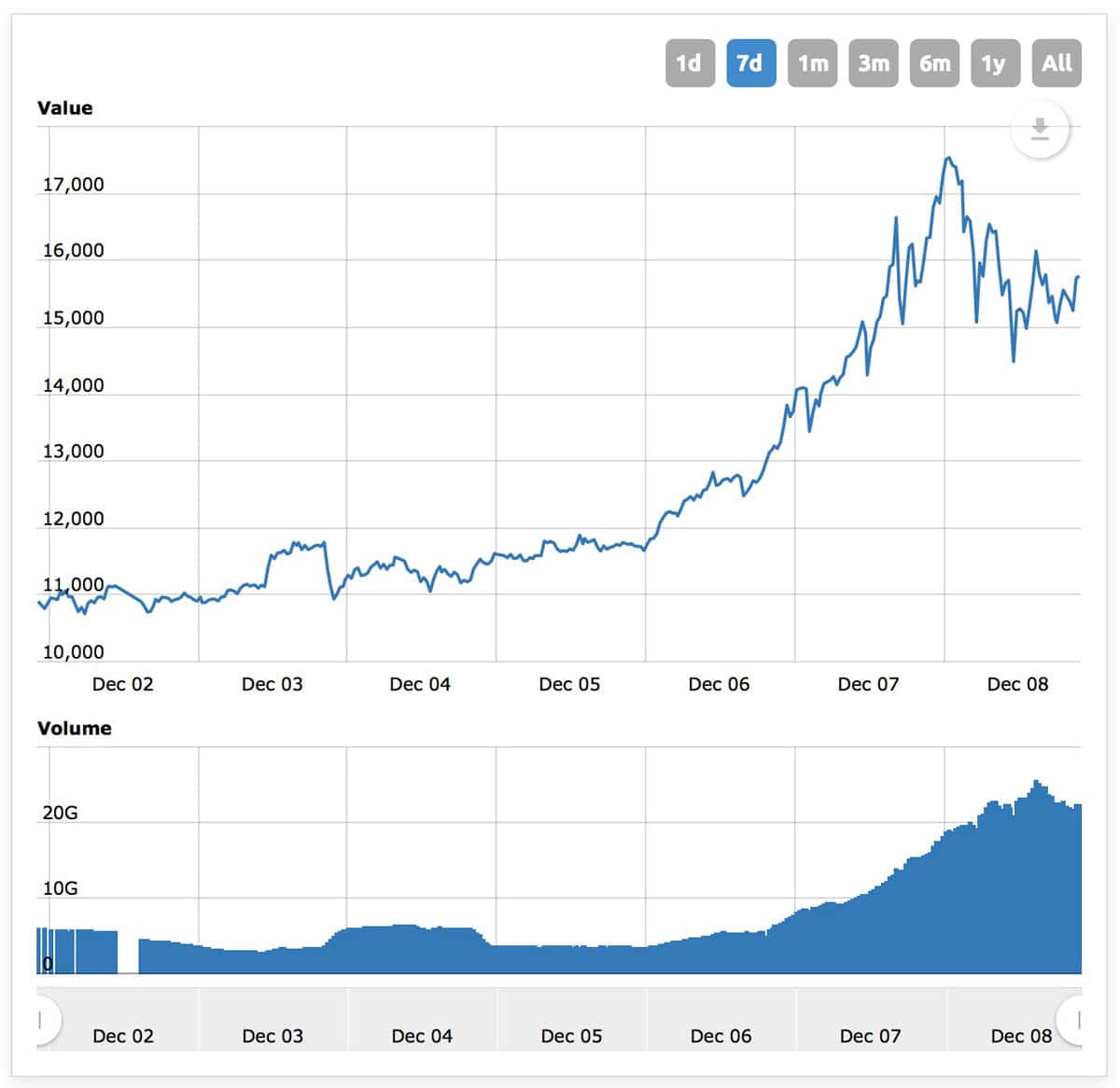

The price of Bitcoin has been shockingly volatile in 2017, and this is particularly true of the last few months weeks days. Bitcoin’s price has risen from US$11,000 to $16,000 in the last seven days, with stops along the way all over $17,000, $18,000, and even brief forays into $19,000 and $20,000 territory.

Here’s a chart for just the last seven days of trading:

Which is insane.

And it begs the question why? The short answer is that no one knows precisely. As small as it is, even the Bitcoin market is too large to understand all of the forces at play. We can, however, examine those factors we do know, including market fundamentals, to try and wrap our heads around what’s happening. With any luck, this article might help you think about the future of Bitcoin, too.

But first, I have warnings and caveats for you.

This Article Is Not Investment Advice

From our Bitcoin primer from Thursday: I’m not advising you to buy Bitcoin. Bitcoin is insanely volatile right now. And worse, it might have peaked or it might be at the bottom of a huge climb to the moon. It could crash at any time. Or not. In 5 years, it could be worth $100,000 or zero. Or anywhere in between. Bitcoin’s past is no guarantee of its future.

And while I am not offering investment advice to anyone, an investing/gambling maxim is never risk more than you’re comfortable losing.

My goal with this article is to help people—especially those new to Bitcoin—begin to understand some of what is happening with Bitcoin’s price.

Why Stocks or (Digital) Commodities Rise

Bitcoin can be sent to other users and used to purchase goods and services (for instance, Overtock.com and Expedia). They can also be traded for fiat currency (i.e. government backed currencies) and other cryptocurrencies on exchanges like Coinbase. Those trades set Bitcoin’s value—it might be more accurate to say those trades represent Bitcoin’s value.

(You can also get tiny amounts of Bitcoin for free from bitcoin faucets. I have a detailed Bitcoin Faucet guide if you’re interested.)

In any market, prices rise when you have more people buying than you have people selling. Conversely, when more people are selling than are buying, the price falls. In the case of Bitcoin, what we’ve seen recently is that many, many new people are pouring lots and lots of money into Bitcoin. That is, at it’s most basic, why Bitcoin is rising.

Why Is All That Money Pouring Into Bitcoin?

The question then shifts to why people are bringing in new money to Bitcoin, and that’s where things get more complicated. Here’s what I’ve been able to suss out as contributing factors to Bitcoin’s rise:

- Pure speculation.

- Bitcoin futures being added to the Chicago Exchange on Monday, December 11th, 2017.

- Increasing awareness driving increasing buy-in in a cryptocurrency ouroboros.

- Limited Supply

- Fear of missing out (FOMO).

On page 2 of this article, I’ll dig into all of these factors more deeply and offer my conclusions.

Next: Digging Deeper into Factors Pushing Bitcoin Higher