There’s an easy way to let Apple steal an entire industry from you. Fool yourself into complacency. Here’s how it happened to the Swiss watch industry.

Apple is a company that relentlessly moves forward in technology. This greatly annoys a few customers, but it has to be. Apple also pays considerable attention to the interets of its customers, especially the youth that emerge into its ecosystem. Doing this, Apple is well prepared to cash in on hot technical and social trends.

A case in point is the Apple Watch. Recently, our Charlotte Henry pointed to some interesting news. “Apple Watch Now Outsells All Swiss Watch Brands Combined.”

She quoted Steven Waltzer, Senior Analyst at Strategy Analytics

Traditional Swiss watch makers, like Swatch and Tissot, are losing the smartwatch wars. Apple Watch is delivering a better product through deeper retail channels and appealing to younger consumers who increasingly want digital wristwear.

Most any company can track trends amongst its customers and react. But the Swiss have been slow to do so. Why?

Yesterday’s Variables

A compelling answer comes from a brilliant analysis by Enrique Dans at Forbes.

“How Apple Killed The Swiss Watch Industry.” In one succinct paragraph, author Dans crystalizes the deeper reason the Swiss fell behind.

In 2015, the year the Apple Watch was launched, LVMH watch division president and Tag Heuer CEO Jean-Claude Biver said the Swiss industry was not afraid of Apple’s new product, because it could not be repaired in a thousand years or eighty years, nor inherited by children, nor would it ever become a status symbol. As is always the case when disruption occurs in an industry, traditional competitors are not able to see the threat, and continue to try to analyze it according to the variables that were important yesterday.

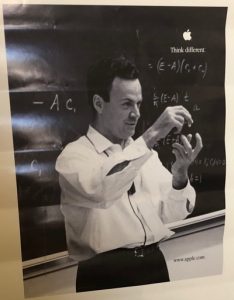

That, in turn, reminded me of a famous quote by physicist Dr. Richard Feynman, who once spoke to a crucial principle of science.

The first principle is that you must not fool yourself — and you are the easiest person to fool.

It’s the Data

Author Dans goes on to punctuate the most compelling thing about the Apple Watch, something to which I can personally attest.

As soon as you start using the Apple Watch, you realize one thing is clear: the rest of your watch collection will live on in a drawer from now on. And every time you’re tempted to take them out and use them instead of the Apple device, you spend the whole day looking at your wrist for information that isn’t there. [Emphasis mine.}

Bingo.

Perceiving the Threat

The inability to visualize the threat is one of the basic reasons companies fail in their competition with Apple. This happend to the Microsoft Windows team that was caught of guard by the iPad in 2010. Former Windows chief Steven Sinofsky explains: “The 10th Anniversary of the iPad: A Perspective from the Windows Team.”

There are few signs that Apple’s competitors are getting any smarter about how to compete with Apple in consumer electronics. Doing that requires study, vision, attention to trends, and the willing expenditure of resources and people to push the limits of modern technology. Even when temporarily flush with cash, many CEOs won’t do that. They fail to perceive the threats and, by virtue of the freedom afforded by their power, fool themelves into self-satisfaction.

Steven Waltzer concluded:

The window for Swiss watch brands to make an impact in smartwatches is closing. Time may be running out for Swatch, Tissot, TAG Heuer, and others.

Time will now tell.

If Apple had “stolen” market shares from the Swiss industry, we would have seen a direct correlation between the increase of Apple’s volumes and the drop of the Swiss volumes. Obviously it is not the case because the Apple watch uses intensive distribution, while high-end Swiss watches use selective or exclusive distribution.

What Apple has achieved is carving itself a niche in the global market of 1,200 million wrist devices that is still dominated by quartz watches.

Where the Swiss have been complacent is in following a trend towards higher price points (selling less units but earning more on each), thus creating a void in the lower price segments that younger watch brands such as Daniel Wellington, MVMT, Filipo Loreti or Vincero have conquered by harnessing social media.

To put things in perspective, Apple’s sales volumes are between those of the Swatch brand (15,5 million units) and the brand portfolio of the Fossil Group (50 million).

The Swiss watch industry, is, to borrow a term, “doomed?”

Well, let’s see — first, it was the Japanese quartz watch that would kill it. It hurt them, but, nope.

Then it was the digital watch. Again, nope.

Then it was the smartphone, and younger generations who don’t wear watches. Guess not.

Now, it’s the Apple Watch? Make up your minds.

Over the years, the Swiss industry has dealt with various challenges, and adjusted by retrenching, and retreating upscale into more profitable niches. Ones that Apple tried, and failed miserably to gain a foothold with the Edition. (How well are those watches working now, by the way? Dead battery? Frustratingly slow? Stuck on WatchOS 4? A nice looking paperweight?)

That won’t be territory Apple can disrupt unless it endeavors to establish its own watchmaking shop in Switzerland, because it’s in a different territory in which Apple competes with its watch — cheap watches and fitness trackers — and Apple’s not in the jewelry business.

Horology enthusiasts have collections, and while Apple Watches may be a part of them, they play a specific role. I have an Apple Watch, which is great when I go to exercise, or as a daily driver to work, but it’s not going to take the place of my other watches when I want to feel like putting something special on, or for an occasion.

Both parties have failed to gain ground on the other’s territory. Apple’s success doesn’t mean the other’s failure.

Shallow analyses viewed through the prism of the tech press fail entirely to understand the appeal of Swiss watches, and those who own them.

“We’ve learned and struggled for a few years here figuring out how to make a decent phone, PC guys are not going to just figure this out. They’re not going to just walk in.”

– Palm CEO Ed Colligan

This comparison is ridiculous. The Swiss watch industry is not a smart watches competitor to Apple. But try to count how many hundreds or thousands Apple watches you can buy for the price of 1 Patek, 1 Nardin and 1 Woucheron…. just to mention few of dozens of manufacturers with a price tag above 300K per unit!

😀