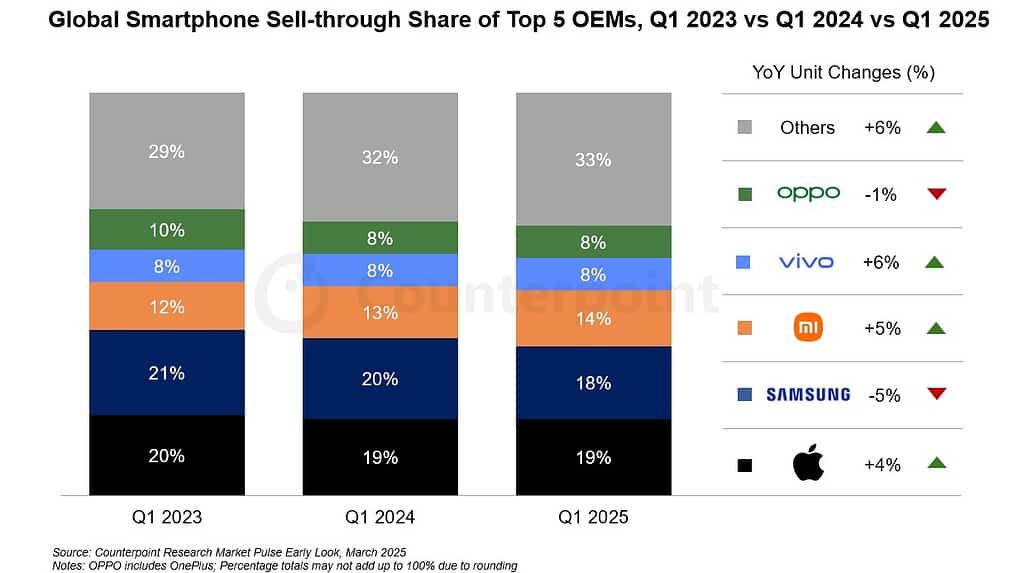

The global smartphone market saw notable changes in Q1 2025, as Apple claimed the top spot for the first time in a first quarter, holding 19% of the sell-through share. This marks a steady position compared to Q1 2024 and Q1 2023, where Apple also maintained a 19% and 20% share, respectively. The launch of the iPhone 16e and growth in emerging markets like India and Japan contributed to this achievement.

Samsung ranked second with an 18% share in Q1 2025, slightly down from 20% in Q1 2024 and 21% in Q1 2023. Despite this decline, Samsung’s March sales showed double-digit growth following the release of its S25 series and new A-series devices.

Xiaomi continued its upward trajectory, reaching a 14% share in Q1 2025, up from 13% in Q1 2024 and 12% in Q1 2023. The brand’s expansion into premium segments and strong domestic performance were major contributors to its growth.

Vivo gained momentum with an 8% share in Q1 2025, maintaining its position from Q1 2024 but improving from its 6% share in Q1 2023. Growth was driven by its presence in China and emerging markets.

OPPO retained an 8% share in Q1 2025, unchanged from Q1 2024 but slightly down from its 10% share in Q1 2023. Despite this dip, OPPO saw sales growth in regions like India, Latin America, and Europe.

The “Others” category grew to represent a larger portion of the market at 33% in Q1 2025, compared to 32% in Q1 2024 and 29% in Q1 2023. This reflects increased competition from brands like HONOR, Huawei, and Motorola, which are gaining traction globally.

More here.