Ireland’s Reaction

Like Apple, Ireland plans to appeal the ruling, although its motivation goes beyond what Apple’s tax bill should be. This is about sovereignty, and Ireland’s government won’t cede control over its tax laws without a fight.

Ireland’s 12.5% corporate tax rate has been a strong catalyst for the country’s economy, drawing in thousands of jobs. Its tax laws are a key part in drawing major corporations into the country, and that’s an advantage the government doesn’t want to give up.

The EU said, “This decision does not call into question Ireland’s general tax system or its corporate tax rate.” That seems a bit disingenuous considering the ruling is a direct attack on Ireland’s tax system.

TMO’s John Kheit wrapped up the issue nicely in his Devil’s Advocate column saying,

The rough issue is that the EC doesn’t like how low Ireland set its tax rates. These low tax rates for tech companies have resulted in quite an economic boom for Ireland, making it the ‘Celtic Tiger’ of the region.

Ireland likes its big businesses, the jobs they bring to the country, and the financial stability that comes from an employed workforce. Those aren’t benefits Ireland’s government will simply give up to appease the EU.

Get Ready for the Fight

With the appeals coming, the EU needs to be ready for a legal fight with Apple, but that shouldn’t be its biggest concern. Ireland is appealing, too, and that means the EU has to square off against one of its member countries along with one of the most valuable companies in the world.

The appeals process is expected to take upwards of four years, and it may not play out well for the EU even if Apple has to pay the €13 billion in the end. This is the kind of fight that could put a permanent wedge between Ireland and the EU, ultimately leading to a less stable union.

With the United Kingdom’s recent referendum to leave the EU still fresh, it’s easy to see how other countries could make a similar decision—regardless of whether or not it’s in their best interest. The EU has a real fight on its hands now, and the ultimate outcome could be far more than the €13 billion it says Apple owes.

This has just been posted by the BBC. Irish government to appeal.

http://www.bbc.co.uk/news/world-europe-37251084

Ireland may not be in the he EU in the future. People are fed up of the EU commission. Ukn as just an example of people being fed up with EU.

Unless your a EU biased economist who made daft predictions on UK bredaft you’ll understand.

“Section 891 of the U.S. tax code, passed in 1934 but never used, allows the president to double tax rates for citizens and corporations of any country the administration considered was discriminating against U.S. companies.”

http://www.rawstory.com/2016/08/little-known-rule-could-let-us-pressure-europe-over-apples-14-5-billion-in-back-taxes/

See today’s Joy of Tech comic:

http://www.geekculture.com/joyoftech/joyarchives/2328.html

@”IRA”: Northern Ireland is not in Ireland.

@”EU get lost”: the reason for setting up Apple Sales in Ireland is the access to the EU common market. If Ireland would leave the EU, Apple Sales would move to another member state with low corporate taxes.

Margrethe Vestager needs to get a proper job. As a Brit who voted for brexit I would advise Apple to tell the EU to get lost. Us Brits voted out (despite Obama and Clinton advice) of the EU for this very reason as the EU thinks it has the right to dictate to subject nation states how to manage their affairs.. Now the US can feel our pain. The EU project is dead in the water. Get lost EU

This is a difficult position to be in; I can conceivably see how politically things like this made sense to attract commercial activity in the 1980s and 1990s when Ireland was in a state of unrest. In the 1990s (and prior) The IRA (Provisional Ireland Republican Army) held control of the Republic of Ireland and was employing guerilla warfare tactics.

Today, however, things are dramatically different. Other computer and telecommunications companies based throughout Europe are held to a reasonable standard; The IRA entered into a cease-fire in the late 1990s.

You’re disingenuous Jeff.

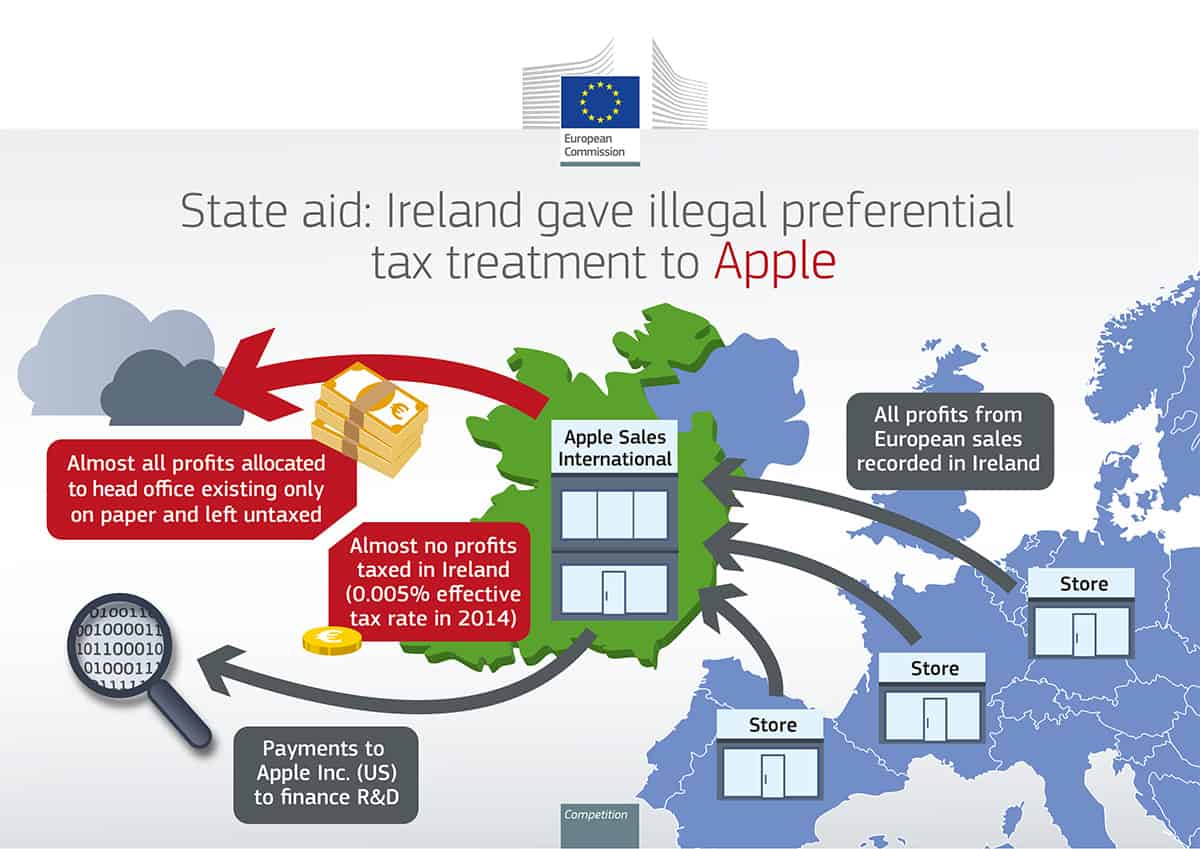

The EC had a problem with offering special tax rates to a single company. If Ireland’s tax rate was 0.005% for all corporations, Ireland would not be in violation of EU law.

Ireland could just withdraw from the EU, add is am independent country from the UK, but then there would be no reason for Apple use them as an EU tax haven any more…