Apple CEO Tim Cook is no longer focused on the iPhone — not the way he used to be. According to a recent Bloomberg report, his attention has shifted almost entirely to one thing: augmented reality (AR) glasses.

Insiders say this isn’t just another project for Cook. It’s the only thing on his plate. “Tim cares about nothing else,” a source told Bloomberg. “It’s the only thing he’s really spending his time on from a product development standpoint.”

AR glasses have now become Apple’s top hardware priority. Cook wants to beat Meta and be the first to deliver a lightweight, all-day wearable device that overlays digital content directly onto the real world. Think of it as replacing your iPhone — but on your face.

The stakes are high. Apple isn’t just building a product. It’s chasing a whole new platform. Gurman says Apple still needs to solve major hardware and usability challenges. That includes ultra-high-resolution displays, a high-performance chip, and a compact battery that can last for hours.

There’s also the question of software. Apple has to create applications that make AR glasses feel essential, not gimmicky. They’ll need to match — or exceed — the usefulness of an iPhone. And they’ll need to be affordable, even at scale.

Despite the hurdles, Apple is all in. Billions have already gone into Vision Pro, and AR glasses are the next step — not a side project. The push comes at a moment when Apple is rethinking how it organizes product teams and reassigning leadership around Siri and Vision development.

Apple Leads Global Smartphone Market in Q1 2025

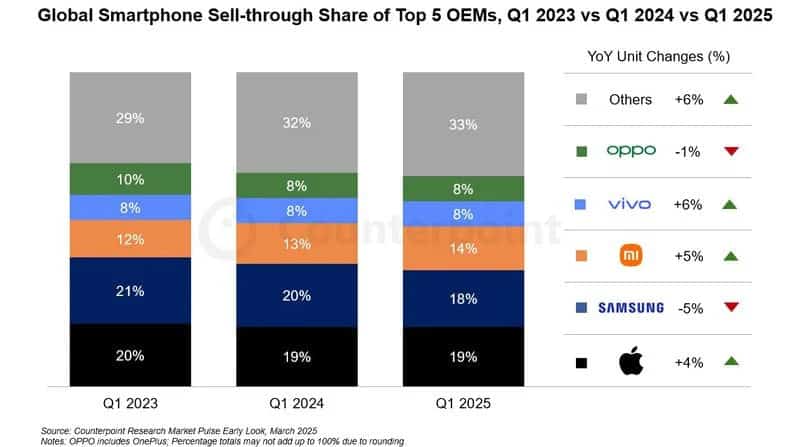

While Cook is looking ahead, Apple’s current business isn’t slowing down. According to Counterpoint Research, Apple took the number one spot in global smartphone sales for Q1 2025 — a first for any first quarter.

Apple captured 19% of the global market, just edging out Samsung at 18%. The iPhone 16e, launched in March at $599, played a key role in that success. It replaced the iPhone SE as the company’s most affordable option and drove growth in emerging markets.

Samsung slipped from 21% in Q1 2023, hampered by a delayed Galaxy S25 launch. Xiaomi took third place with 14%, followed by Vivo and OPPO. Notably, Apple’s growth came from outside its core regions — the U.S., Europe, and China saw flat or declining numbers, but Apple posted double-digit gains in India, Japan, the Middle East, and Southeast Asia.

Overall, the global market grew 3% year-over-year, but rising tariffs and economic uncertainty could still drag down full-year growth. Counterpoint has lowered its forecast accordingly.

Still, that success doesn’t seem to be where Tim Cook is placing his bets. While the iPhone remains Apple’s core business today, it’s clear that Cook is looking toward a future where AR glasses become the next iPhone-level product.