I’ve wondered for years why PayPal wasn’t involved in cryptocurrency. I mean, PayPal’s been built as a digital financial platform, and is arguably the oldest one. Furthermore, the service already allows international money exchange. As for bitcoin and other cryptocurrencies, they’ve proven that these decentralized currencies are going to do nothing but grow in popularity. Still, PayPal and Bitcoin never seemed destined to work together. On Wednesday, though, PayPal announced that support for cryptocurrencies is coming within weeks.

PayPal and Bitcoin, Together at Last

The problem with mainstream adoption of cryptocurrency, according to PayPal, is its “limited utility as an instrument of exchange due to volatility, cost and speed to transact”. A typical bitcoin exchange transaction can take anywhere from 30 minutes to an hour, depending on how effectively the blockchain is operating.

Dan Schulman, president and CEO of PayPal, says that central banks are working to solve this problem. Renewed and new interest in the market is booming, especially with COVID-19 keeping so many people isolated. Schulman also explained why it makes sense now for PayPal to enter the cryptocurrency market.

Our global reach, digital payments expertise, two-sided network, and rigorous security and compliance controls provide us with the opportunity, and the responsibility, to help facilitate the understanding, redemption and interoperability of these new instruments of exchange.

A recent survey of financial institutions shows that about one in 10 central banks is expecting to issue its own digital currency within three years. Schulman wants PayPal to be ready to support that.

We are eager to work with central banks and regulators around the world to offer our support, and to meaningfully contribute to shaping the role that digital currencies will play in the future of global finance and commerce.

New Support for Buying, Selling, and Holding Cryptocurrency

In the coming weeks, PayPal customers will be able to buy, hold, and sell cryptocurrency from their accounts. PayPal competitor Square launched support in 2018, throughputs CashApp product. However, that support is still only for bitcoin, not any other cryptocurrencies.

PayPal, on the other hand, will begin supporting not only bitcoin, but also Ethereum, Bitcoin Cash, and Litecoin. PayPal’s will launch its cryptocurrency sipport in the next couple of weeks in the U.S. The company’s money-sending platform Venmo, along with international markets, will see support starting in early 2021.

What the News Means for Consumers

This means consumers will be able to purchase cryptocurrency straight from their PayPal account. They can hold it, to allow its value to potentially increase. Users will also be able sell cryptocurrency to others, or use as a payment method for purchases at PayPal’s 26 million merchants worldwide.

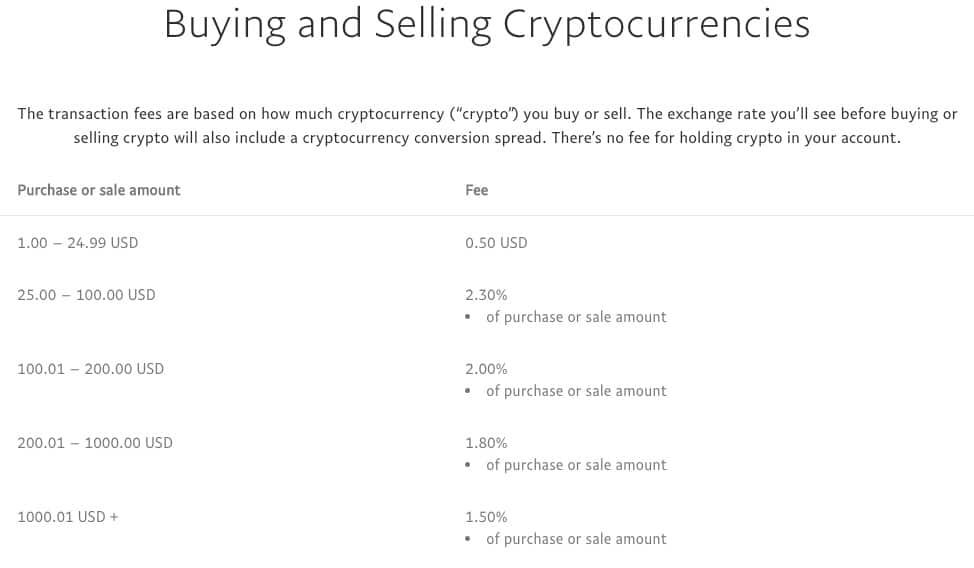

Until December 31, 2020, PayPal won’t be charging any fees to buy or sell cryptocurrency. After that, the company will charge a small percentage of the transaction total, which is almost the de facto standard in cryptocurrency exchange.

Maybe A wallet, but not MY wallet.

@53 I knew there was a reason I used “a wallet” in that title!