The day before yesterday marked the fifth anniversary of the Apple Card, Apple’s first and only branded credit card, which launched on August 20, 2019. Despite initial ambitions for global expansion, the Apple Card remains an US exclusive Apple product, primarily due to regulatory challenges.

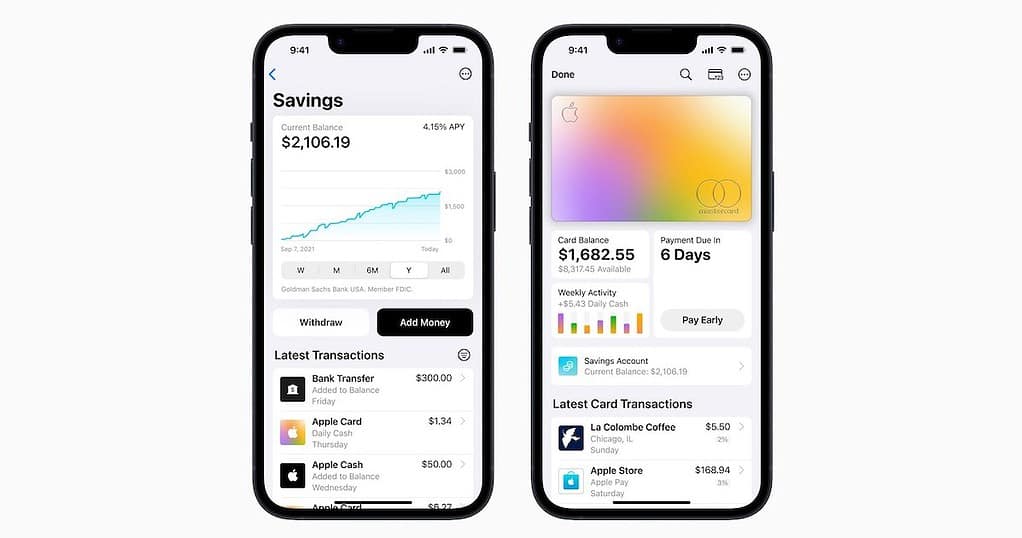

Developed in partnership with Goldman Sachs, the Apple Card has a no-fee structure, with no annual, international, late payment, or credit limit fees. Users benefit from a Daily Cashback program, earning 1% on all purchases, 2% on Apple Pay transactions, and 3% on Apple Store purchases.

This cashback is credited to users daily. Not just this, the card is deeply integrated with the Apple Wallet app, hence seamless spending tracking and financial management.

But the partnership with Goldman Sachs is set to end in 2025, which means that Apple needs to find a new provider for the card in the U.S.

Despite these challenges, the Apple Card has consistently received high customer satisfaction ratings and has been praised for its user-friendly features and integration with Apple’s ecosystem, which is sort of expected with Apple. Apple wouldn’t be Apple without it, would it?

Do you know what else is US-exclusive? Apple Cash. This service lets users send and receive money through iMessage and is only available in the United States.

While Apple had previously expressed interest in expanding the card to Europe, Hong Kong, and Canada, no concrete steps have been taken.

What do you think? How long will the Apple card remain the US-exclusive Apple product?

More here.