If you’re reading this, you want to know how to make money from Bitcoin faucets. I’ve been using Bitcoin faucets for years, and moderate the #1 guide for Bitcoin faucets that actually pay. I want to share what I’ve learned.

[Update 10/6/2017: Updated the section on my favorite faucets to reflect some recent changes with how those faucets work. – Bryan]

Originally published June 15th, 2017

What Is a Bitcoin Faucet?

Bitcoin faucets pay out a few satoshis when you load a page full of ads, roll a random number generator (on a page full of ads), or play some other game (on a page full of ads). Some sites, like Freebitco.in and Bitgames.io, use faucets as a loss-leader to get you to the site. Bitcoin faucets won’t make you rich, but they’re a great way to get involved with Bitcoin and the cryptocurrency phenomenon without buying Bitcoin.

Here’s my thesis: Bitcoin faucets pay out a fraction of a penny per use. What’s worth a fraction of a penny today will be worth more tomorrow—if Bitcoin rises. Will Bitcoin rise? Probably. It could also crash. I’m a believer in Bitcoin’s longterm viability, but your mileage may vary.

That’s what makes Bitcoin faucets so appealing to me. They’re a fun hobby with upside potential.

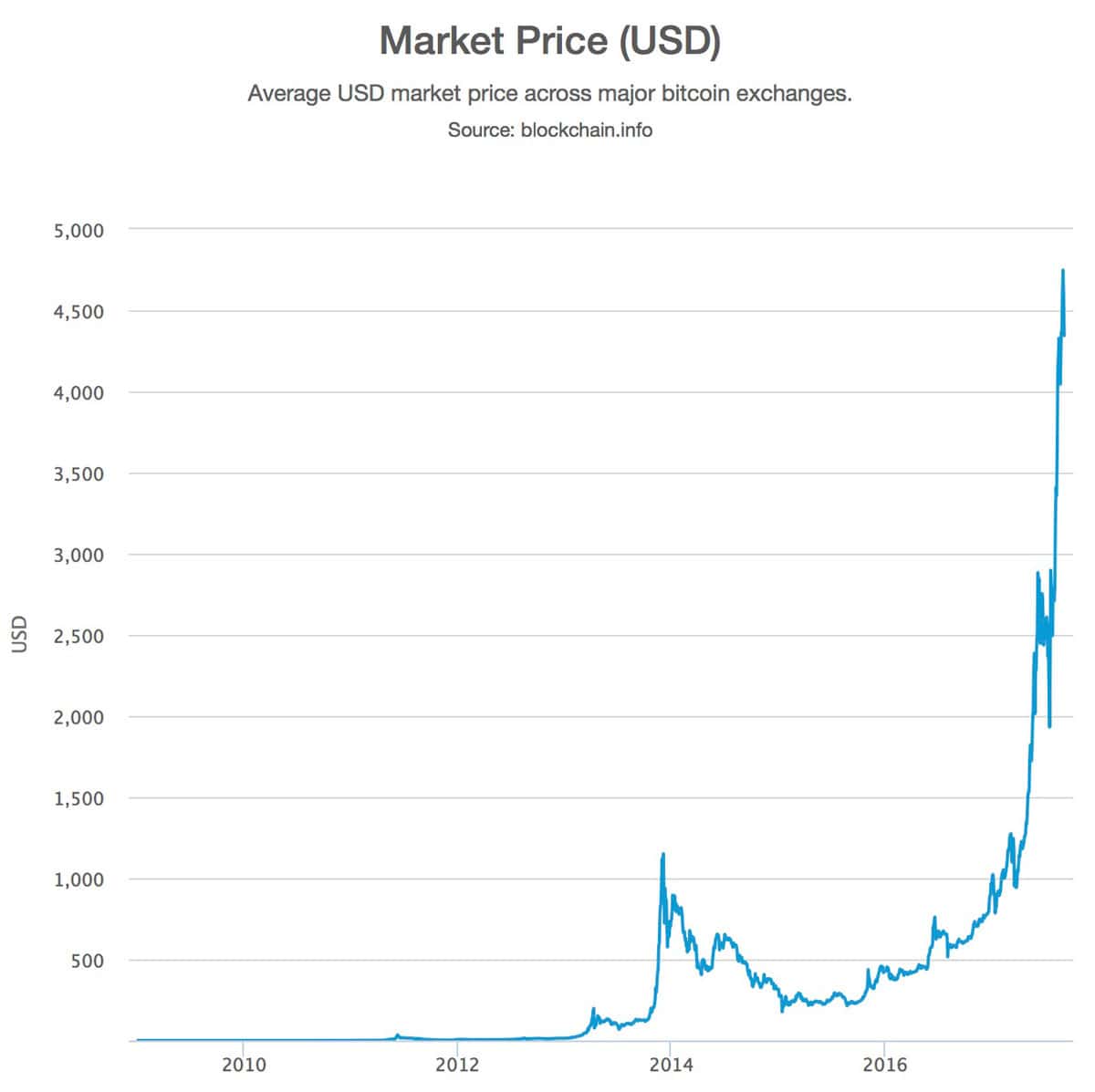

Here’s a lifetime chart of Bitcoin’s market value. Note the large number of big and little spikes and corrections in the graph.

Bitcoin Wallet

All Bitcoin faucets require a Bitcoin address, and for that, you’ll need a Bitcoin wallet. I’ve personally used Blockchain.info‘s wallet, a cloud-based wallet. Hardcore cryptocurrency enthusiasts only trust wallets they run on their own computer or smartphone, but I’ve personally been happy with Blockchain.info. Blockchain recently added support for Ethereum, too.

Coinbase is also a popular cloud wallet (and exchange), and it supports Bitcoin, Ethereum, and Litecoin. Bitcoin Cash support is coming in January.

Bitcoin Faucet Math

The best Bitcoin faucets tie their payouts Bitcoin’s price. They’re using exchange APIs to buy satoshis on the fly so that their costs are constant in dollars. This is why you’ll see payouts on some faucets rise and fall throughout the day. FreeBitco.in exemplifies this model.

Some faucets—like those that use microwallets such as FaucetHub.io—pay out from wallets pre-filled by their operators. Most of these display the faucet balance right on the page.

Bitcoin Faucet Pro Tip

Here’s a pro tip for Bitcoin faucet enthusiasts: when the price of Bitcoin falls, that’s when you redouble your efforts. Look at that chart above. Bitcoin has heretofore spiked, fallen, settled out, and risen, time and time again. There’s no guarantee that will continue, but I’m an optimist.

Interest in faucets spikes along with the price of Bitcoin. Traffic to our guide goes up with the price of Bitcoin, and so do the number of people clicking through to faucets I recommend. Conversely, interest in faucets goes down when the price of Bitcoin falls.

I understand how that happens, but faucets pay fewer satoshis when Bitcoin goes up. If you want to accumulate more Bitcoin, redouble your efforts when Bitcoin falls, and stay with it when it rises.

Bitcoin Faucet Basics

Some faucets pay out automatically and some require users to trigger a payout. Understand how your faucets work and make sure you withdraw those satoshis! The worst thing you can do with a faucet is earn Bitcoins and leave them sitting there forever.

There are untold numbers of faucets. Many are scams, poorly maintained, or abandoned. This is the point behind my guide to faucets that actually pay. I do the work of finding legit faucets.

But, there’s a finite number of faucets any one person has time for. Pick and choose your battles by focusing on faucets that pay well and are fun. If you don’t like a faucet, move on to another.

Bitcoin CAPTCHA Tips

CAPTCHA systems (try to) stop bots from using Bitcoin faucets. Some use text humans can discern, but computers find difficult. One of those systems is ReCAPTCHA, which is operated by Google.

Tip for ReCAPCTHA: Log in to Google on the browser you are doing your faucets in. That plays an unspecified role in Google’s algorithms for determining whether you’re human. When I’m logged in to Google, oftentimes I don’t have to click through a ReCAPTCHA at all.

Tip: If your faucet offers a choice in CAPTCHA systems, proactively choose the one you find easiest.

Tip: Reload a CAPTCHA if it’s too hard or annoying. I skip every Google ReCAPTCHA that requires you to click squares until no matching criteria are left. Those take too long and are an excellent example of engineers designing for a problem instead of the user.

Solve Media is the next most popular CAPTCHA with a mix of advertising videos and text. The videos take too long, and I reload them until I get text. Rarely, Solve Media comes under bot attack, and their CAPTCHAs can become illegible. There’s nothing to do but reload until you get one you can read.

There are many other CAPTCHA systems, too, and some faucets even use more than one. Don’t lets difficult or annoying CAPTCHAs get the best of you. Abandon faucets that make it too hard for you to use them!

The Best Bitcoin Faucets

Here’s a cheat sheet of my favorite faucets I use when I’m short on time.

FreeBitco.in: This is the king of faucets. They offer reward points, free lottery tickets, and they pay interest on your balance (above 30,000 satoshis). They also offer gambling games I haven’t tested.

FreeDoge.co.in: It’s the sister site to FreeBitco.in and works the same way. They don’t have the rewards, lottery, or interest.

MoonBitco.in: This faucet (and its sister sites MoonDoge.co.in and MoonLiteco.in) is unique in that it adds 1 satoshi to its payout every few seconds. The longer you wait between collections, the bigger the payout. There’s also a loyalty bonus for daily visits, and a mystery bonus, both of which can significantly increase your payouts. This is consistently one of the highest paying faucets out there.

BitGames.io: This faucet pays very well. BitGames.io has also become my favorite task site. Watch videos, visit sites, fill out surveys, download apps, etc., all in exchange for satoshis. Make sure to confirm your email when you register or you can’t withdraw.

BonusBitcoin: This is the highest-paying 15 minute faucet around. It’s fast with occasional popup/redirects.

I can run through all of those faucets in less than a minute, and do so throughout the day. When I have more time, I use the other faucets in my guide.

It now appears that Bitcoin (BTC) bulls have been able to gain the upper hand over bears in the time following the intense volatility that the asset incurred early this week during its sudden “flash crash” that caught investors off guard. Because BTC is now slowly climbing back up towards the coveted five-figure price region, it does appear that it is shaping up to once again see a sharp upward movement that leads it past the resistance it faces at $10,000. In the near-term, analysts believe that the crypto’s defense of key support may be a bullish sign, leading one top trader to anticipate the ongoing BTC uptrend to continue strong in the near-term. I am indeed happy I listened to the right people and also started trading using Richmond daily signals which are so accurate, I made a 300% profit on 1 BTC in just 2 weeks. If you have any issues and need his expert opinion, you can reach out to him on WhatsApp (+17063505497) concerning his trade system for more information regarding his system.

Hey Bryan,

Happy $500 billion market cap day!

My name is Steve with BitDigger and I wanted to share our chrome plugin with you:

[Snip – Got the link. I’ll check it out. Thanks, Bryan]

This was a handy guide, thanks for sharing.

Excellent Bitcoin faucet

[link removed, malware infested – Bryan]

Some time in the future, the Bitcoin bubble will burst just like the more famous bubbles of yesteryear (Tulips, South Seas, etc.) and it will be just one more in the list of markets that people invested their money without fully understanding what they were investing their money in.

After all the fancy-shmancy talk of block-chains, decentralized administration, anonymity and whatnot, in the end bitcoins are non-fiat currency. The kind of currency that the US and other governments started to phase out in the 19th century because they are prone to wild speculative swings, with no one other than pure blind faith guaranteeing their value, and are thus susceptible to periodic panics that lead to greater economic volatility that cause real hardship to real people. This is the lesson from history that bitcoin advocates want you to not learn or forget.

The only people who really benefit from crypto-currencies are drug dealers, child porn addicts, malware scammers, money launderers, and other such criminal types.

One consideration of which I was not aware until recently was the question of fees and processing time. A Bitcoin “transaction” (payment from one wallet address to another) lists all the inputs that are involved, as well as the output: inputs are all the transactions from which you received any of the satoshis you are sending, and the output is where you are sending them. A large-value transaction to spend what you’ve earned from many tiny faucet payouts will have dozens of inputs; I recently tried to spend about 0.2 BTC, and the transaction was over 18 kB! (A minimal, one-input transaction is a hundred-something bytes.)

The problem is that, with congestion in the blockchain during periods of high activity, you have to attach a significant fee to your transaction in order to entice “miners” to confirm it so that the transaction goes through with reasonable priority. The wallet software I was using attached a fee of about 10 satoshi per byte, which was ridiculously low (https://bitcoinfees.21.co is currently recommending 360 satoshi per byte for quick confirmation!), and I waited three weeks for the transaction to go through! There is no way to cancel the transaction (without significant hacking to “fake” a double-spend fraud), there is no way to tell when it will go through, there is usually no way to boost the fee after the fact to expedite confirmation, and as far as I am aware there is no guarantee that it will _ever_ go through; and while the transaction sits there unconfirmed (in the mempool, as they say) its value is of no use to anyone — not the sender, not the recipient.

That was a 1% fee on the value of the transaction; I recently did another with a fee of 375 satoshi per byte, which was almost 10% of the value of the transaction, and it still took three days! If, like me, you have obtained most or all of your Bitcoin from faucets, and you are using your own software wallet so as not to trust an online wallet held by a company that might get cracked or go belly-up (Mt. Gox, anyone?), then be prepared either to spend a lot to actually use your satoshi, or wait an indeterminate time to do so, or both. Brian, you say you use an online wallet. I _think_ that this should solve the problem of large numbers of transaction inputs (i.e., large transaction size in bytes, and thus large fees) because the online company will absorb all the faucet payouts and send your value from a single input; is that correct? How does your online wallet figure fees when you spend your Bitcoin, and do you pay the fees or does the company cover them?

I have not had this problem with Litecoin or Dogecoin; for my Bitcoin faucets, I’m thinking that as an intermediate step I will take advantage of FreeBitCo.in’s (interest-bearing) deposit feature by sending other faucets’ payouts there, and then only occasionally taking a payout from them to my independent software wallet. I am loath to trust a company that (as I am mathematically certain, per my comments on your other articles) lies about their “provably fair” game ever paying above the third-tier prize, but since I will just use it as a buffer the value at risk at any time will be minimal. Certainly less than I’ve lost on some other faucets that went belly-up before paying out!

Thanks, geoduck. 😂

But…I have a possible out for you: Bitcoin faucets aren’t investments in that you aren’t buying what you get. Sure, you’re spending your time, but it might be a good enough loophole for you not to doom us all…

A few weeks ago somebody posted an article entitled

“If You Had Bought $100 of Bitcoins in {some year I don’t remember} They Would Be Worth Over a Million Dollars Now”.

To which I replied

No

If I had bought $100 of Bitcoins in {SYIDR} they would be worth a few pennies now.

If I had invested in Bitcoin, the market would automatically have collapsed.

I knew it would happen so I didn’t invest.

I didn’t want to do that to you.

You’re welcome.

So all of you making a killing in Bitcoin have me to thank.

Gratuities Gladly Accepted.