U.S. President Donald Trump seems committed to escalating trade tensions with China. But most U.S. electronics manufacturers—Apple included—still rely heavily on Chinese imports for parts or even finished products. Here’s how these tariffs could impact Apple’s 2025 product launches.

The Current State of Trump’s Tariffs

First 34%, then 54%, then 104%, then 125%. Since he took office, Donald Trump has bumped the tariffs on Chinese imports at least three times.

Trump’s intention is to force China to negotiate better terms — better for the US government, in this case. China isn’t inclined to bulge either, so, each time Trump announces a tariff raise, so do the Chinese.

Presently, tariffs are set at 10% for countries that agree to discuss commercial agreements with the US. These terms are valid only for the next 90 days, though. Meanwhile, tariffs for Chinese products have been raised to 125%.

Will The Tariffs Last?

The actual answer is a huge “maybe.” As extreme as some of Trump’s decisions may be, he isn’t known for backing off from them. But there are some aspects to consider.

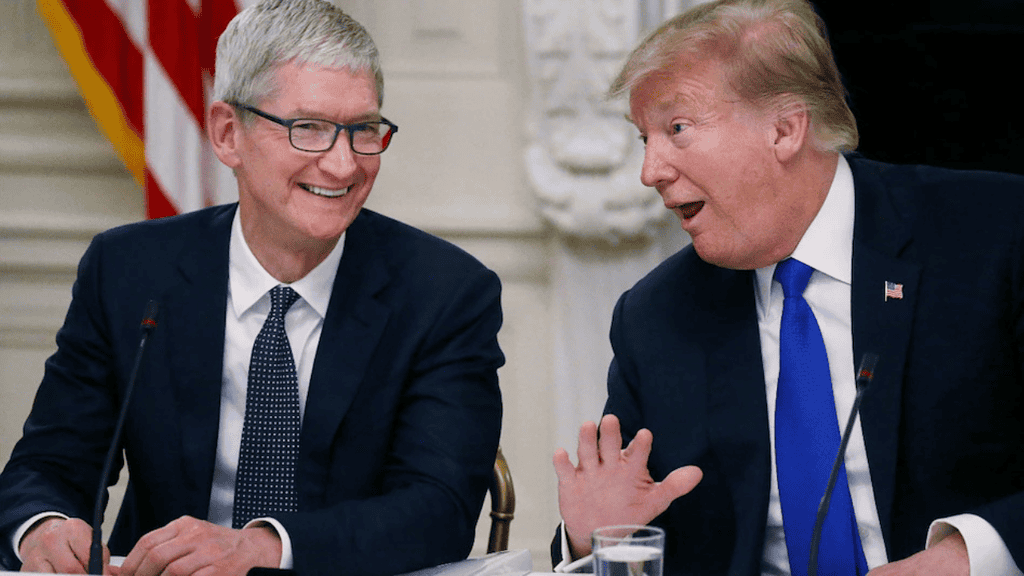

During Trump’s last term, he imposed tariffs on Chinese imports as well. Apple’s CEO Tim Cook, however, negotiated directly with the president and got the company an exemption. Now, Trump himself is already talking about lowering the tax for some companies that were “hit harder” by the tariffs.

How Trump’s Tariffs May Affect Apple’s 2025 Product Releases

There are three possibilities for how the company will deal with Trump’s tariffs, regarding Apple’s 2025 product releases. It may delay announcements, increase prices, or even limit the availability of some devices.

Delays

Apple sometimes delays product availability. It has done that recently, e.g., for Siri 2.0 and the AirPower charging mat, which eventually was canceled altogether.

The company isn’t known, however, for often delaying product announcements. One exception was in 2020 when most products were launched later than usual due to the Covid-19 pandemic. Another fairly recent case (ongoing, actually) is the yet-unnamed HomePod-iPad “Home Hub” hybrid.

In both cases, however, the reasons weren’t directly related to the products themselves. The whole world stopped in 2020, and, if you believe the rumors, there are stocks of “Home Hubs” piled somewhere. The company has called off the announcement, expected for last March because Siri wasn’t good enough. The device relies heavily on the assistant for most tasks, so releasing it without a complete Siri overhaul wasn’t feasible.

In turn, both AirPower and Siri 2.0 are considered two of Apple’s major fiascos, something very unusual for the company. And Cupertino is highly unlikely to willingly make such mistakes, as would be the case for tariff-related announcement delays.

Availability

What the company could do, however, is limit product availability in the US. Instead of, say, having 100,000 units of each iPhone model available in the country at launch, only have 50,000.

This would tackle two issues at once. Firstly, it would attune to the smaller customer base expected with the higher price tags — more on that in a bit. Secondly, it would free stock to be sold in other countries, where tariffs wouldn’t be an issue. In these countries, the profit margin would also be higher.

Pricing

Lastly, tariffs are expected to impact even current devices, with iPhone prices possibly increasing by over $350 for some models. Future announcements will be hit even harder: there’s no way for Apple to stockpile units like it has been doing.

Analysts estimate the iPhone 16 Pro Max could end up retailing for as much as $2,300 because of Trump’s tariffs. However, this is a worst-case scenario, that involves many unlikely aspects.

Prices Will Likely Increase — but Not for Now

This price point would only be attained if Apple kept the manufacturing restricted to China, with the highest possible tax. The company, however, is already ramping up production in other countries, like India, Vietnam, and Brazil. While these countries involve other cost issues, like higher workforce salaries, the lower tariffs would make up for those.

The $2,300 price tag also considers Apple will completely forward the cost to customers. The thing is: for current devices, with the strategies it has been adopting, the company may manage to avoid that. Since most of them are well into the retail life cycle, they have created enough revenue to compensate for costs. Because of that, Apple may choose to refrain from raising prices instead, absorbing additional fees by cutting its profit margin.

For future products, on the other hand, Apple will likely need to offset the tariffs to customers. In this case, a 1TB iPhone 17 Pro Max could very well retail for over $2,000.

Apple has seen its fair share of doomsdays. In the 1990s, the company had to rely on its biggest competitor, Microsoft, for financial aid. In 2018, it lost 40% of its market value. And, right now, the company may need to deal with skyrocketing prices in one of its main markets.

The company closed the 1990s announcing the iMac, a product so iconic it still inspires most of Apple’s device names. Since the 2018 downfall, Apple stocks have tripled in price. It will certainly need to adjust course in some aspects, but Trump’s tariffs are unlikely to significantly impact Apple’s products. In the long run, at least.