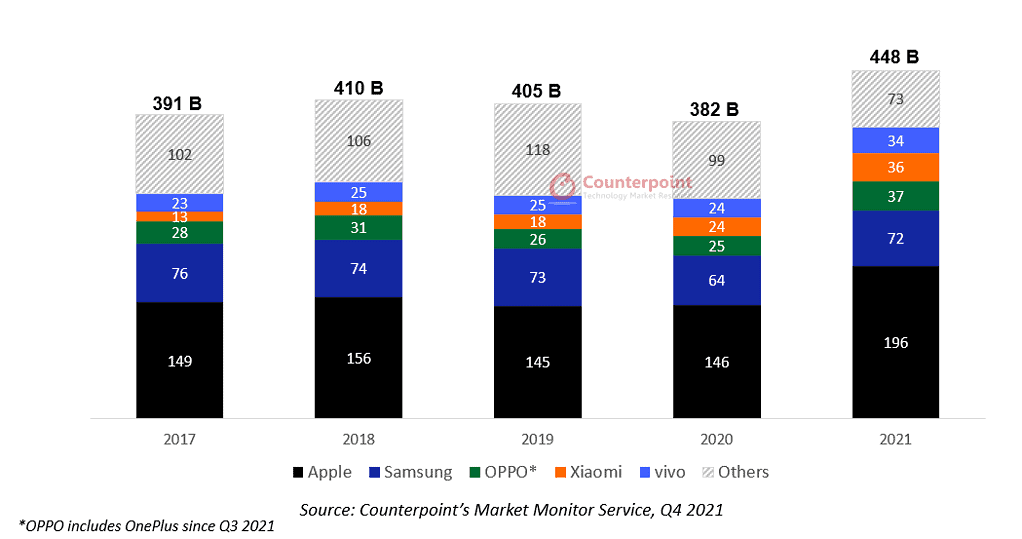

Despite the havoc brought about by the COVID-19 pandemic to the global economy, it is still a bit surprising to know that the global smartphone market has been seemingly unaffected. According to the latest market research, global smartphone revenue in 2021 hit a record high of US$448 billion in 2021. Apple led the global smartphone market by capturing the highest share of the market in Q4 2021.

The global smartphone market research was conducted by Counterpoint, an independent global industry analyst firm through its Market Monitor Service. According to the research, the global smartphone revenue grew by 7% YoY and 20% QoQ. This is despite the shortage of components and various COVID-19 restrictions that have affected the manufacturing process of smartphones globally.

The research also showed that the average selling price (ASP) grew by as much as 12% YoY reaching US$322. The increase is attributed to the higher share of 5G smartphones which have higher ASP than their 4G counterparts. Another factor that contributed to the growth in ASP was the release of Apple’s iPhone 13 devices in September 2021. Other smartphones offering 5G capability that were released by other manufacturers, particularly Chinese companies such as Oppo and Xiaomi, also contributed to the increase in smartphone ASP.

Incidentally, both Oppo and Xiaomi recently vowed to challenge Apple and Samsung in their current dominance of the smartphone market. Oppo, which recently merged with another Chinese smartphone maker, OnePlus, is putting its stake on the overseas high-end market in 2022. The company is pushing smartphone models featuring a self-developed image processor. Its current Find Series smartphones that feature fast processors and other advanced features are the company’s bet on getting a fair share of the high-end smartphone market.

Similarly, Chinese smartphone giant, Xiaomi is also focusing on its high-end smartphone offerings to challenge both Apple and Samsung. Company founder and chief executive Lei Jun said that his company is currently benchmarking Apple’s product and experience to become China’s next biggest high-end smartphone brand.

One thing to note here is the fact that both Oppo and Xiaomi were known for their more affordable smartphones. If both companies maintain the current price range of their 5G-enabled smartphones, it will only be a matter of time before they steal away Apple’s share in the smartphone market.

According to the research, 5G-enabled smartphones contributed more than 40% of the global smartphone shipments. Most of these shipments are iPhone devices that, as we all know, carry a hefty price. If Oppo, Xiaomi, and other smartphone manufacturers continue to offer more affordable smartphones with features at par with that of the iPhone, this market research could have different results come 2023.

The market research clearly shows that despite its dominance in the smartphone market, the 35% increase in Apple’s revenue share is below that of the increase in the revenue share of Oppo, Xiaomi, and Vivo with 47%, 49%, and 43% respectively.

With the ongoing pandemic, the demand for affordable smartphones outweighs that of the demand for more expensive ones. People recognized the need to upgrade their mid-range smartphones to premium devices for a better overall experience when it comes to the demands of online education, work from home, and even entertainment needs. But at the end of the day, price is still what matters, especially as countries struggle to recover from the economic crisis brought about by the COVID-19 pandemic.